Written and voiced by Sean Dowd, CPA

What’s this all about?

A look of horror. That’s what he gave me. I’ll never forget it.

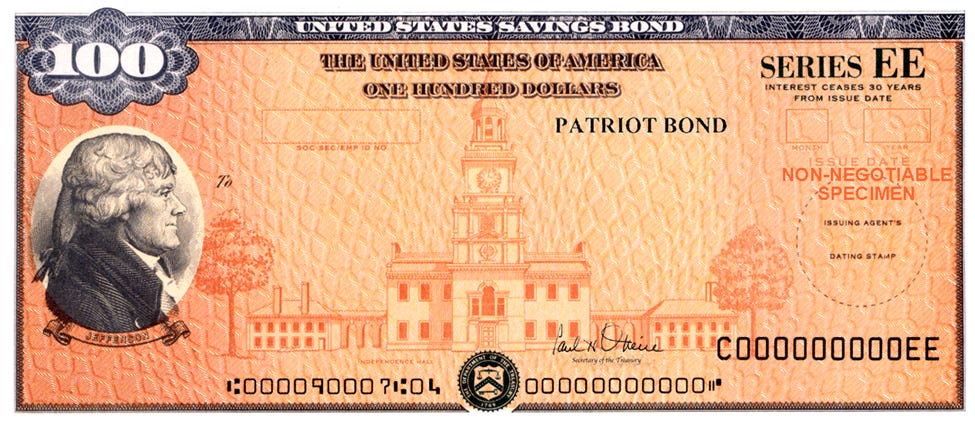

My Uncle Bill was married to my Dad’s sister. So, he was an uncle-in-law. We don’t get that technical. He was Uncle Bill. He was also my God Father. Every year on my birthday he and Aunt Joan would send me a crisp $100 US savings bond. It looked like cash. But it wasn’t cash, so I didn’t spend it right away. But I knew it had weight. I just had to wait.

I’m not sure, but I think my Aunt Joan, my Godmother was important to my Dad. Possibly more so than some of his other siblings. But as much weight that the consideration of who would be a God parent would be exerted, and whether it was ceremonial or truly intended, “they” decided on Aunt Joan and Uncle Bill. My understanding of it was in the event of the death of both parents, they would raise me. Who knows if that was truly the plan? As it turns out I received a card with a savings bond every year for approximately 17 years.

With insincere humility I expressed to my uncle they didn’t have to do that. He replied that he only had to pay taxes and die. I didn’t “appreciate” the gift because I wasn’t getting immediate gratification. I eventually cashed in my bonds. I can’t say for sure what I spent it on. It probably went to one of my cars for pointless repairs.

I liked my uncle Bill. Two memories of him stand out to me explicitly. One of him and I standing next to each other somewhere in Florida. His button-down shirt is completely open, his undershirt is exposed, and a cigarette is in his hand. Old school cool. The other image is of us on Lake Erie on the Canadian side in a rowboat; I’m hysteric. I thought the horizon in the distance was a waterfall and if we got too close, we’d fall off. I blame Mr. Wizard and a visit to Niagara Falls for that fear.

I was being taught to fish. I remember the rod and being told to feel it for the bites. At least I think that’s what they were telling me to do. Maybe I was supposed to feel the line. Fleeting moments that were special.

You can spell Texas with taxes. Taxes are kind of boring. In fact, I sense your eyes watering with just the word… tax. But they touch everything in your life. Texas touches everything in your life. I spent two weeks in Texas in 2005. I’ve been working in taxation since 2009 (13 years), and aside from Professor Sinning at WMU I haven’t met someone who I can confidentially say has a high-level understanding of just about everything tax related from A to Z. Our elected officials don’t. Stable geniuses don’t. That guy with loads of cash doesn’t. I definitely don’t.

Subject to tax: Your house you rent/ own: real estate taxes. The car you drive: sales tax and personal property taxes. The fuel for that car: sales and excise taxes. The utilities you consume. The stuff you buy: sales tax, value added taxes (VAT), tariffs on shoes and other things, use taxes. The insurance you purchase. The books, songs, and movies you consume. In many places the food you eat that’s cooked and uncooked. In Michigan we don’t pay tax on unprepared food, but many do and they’re getting pissed. Raw hamburger no tax. Big Mac, 6% tax. Alcohol is taxed. So is marijuana.

Puritanical.

That’s the synopsis. Primary sources for inspiration of this post are at the bottom of this thread below the desktop heading. If you’re intrigued, read on.

Thank you for reading.

Please give me the opportunity to be wrong. I’m looking for your help to provide feedback, guidance, and support. Please let me know how this engages you. You can do a thing. I can do a thing. Together we can do great things. Please consider subscribing, liking, sharing, tweeting, texting, forwarding, faxing, printing, snail mail, & airborne leaflet propaganda. It just needs to catch the Forward Flu (go viral).

The Good Stuff:

When I started learning about taxes, I was 15. I had my first thought of “what about mine?” moment. All I knew is I wanted more. To hell with the actual mathematics of the thing. I was in Gimme Gulch. My mom who was raising me was getting money back. I incorrectly thought I should get some of her refund.

Take out prejudice.

When I was studying taxation in college, I was a Republican. Mainly as a form of defiance against my family. It’s a long and stupid story. When I’m assessed by the current (and probably flawed) standards I fall pretty much in the middle between a Communist and a Nazi, and an anarchist and a authoritarian. All those nuances are a topic for another time, and maybe even a different forum.

Taxes are charges levied by a government against an individual person or legal entity taken to fund programs and direct the flow of the populace to a tangible or intangible direction. There are two general types of taxes. Taxes on the cash or property that comes to your hand (directly or indirectly) from something you’ve done or have been deemed entitled to, and taxes taken out of the money or property that comes out of your hand or that you relinquish, when you occupy or consume something (directly or indirectly).

The space between is where things get complicated.

Including my Uncle Bill, I lost all most of the impactful and older male influences in my life before I was 25. He passed away a year or so after my Aunt Joan died in 1998. A broken heart.

At Aunt Joan’s funeral I stood before him. His eyes exhausted, red, and glassy. I was taller than him now. I probably looked like a man. Thinking about it now, Aunt Joan might have been taller than him too. But she was tall. Most of the Dowd’s are. I inherited a short torso and long legs. With a proportionate torso I would be 6’ 5” probably. Stupid genetics. Instead, I’m currently 5’ 11”.

Unnecessary distractions.

Uncle Bill looked at me in a way no one else has. I pissed on his shattered heart. The only other person I’ve elicited that type of emotional response from is Emily, my wife. As he shook my hand a little longer than usual, but still firm in pressure and gazed at me with tenderness I jerked my hand away.

I can’t forget the look.

I wasn’t trying to be a moody teenager, but that’s sure as hell what it probably looked like. I just decided that moment to explore an existential question of when to break a handshake. After the cemetery I never saw him again. That was the last time I ever talked to him.

In human relationships forgiveness is a tax. It’s collected and given through deed, time, and property. The most tolerant and confident people have found the balance between living well and forgiveness of themselves and others. Economically the tax of forgiveness is what keeps us afloat. It displaces the chaos and the coldness of the ocean.

Taxes are the rudder of our world. They steer our destiny. From before birth to long after death. With your understanding or lack of understanding in economics, they cause shifts in the supply and demand curve. They encourage or discourage behavior. When first learning about taxes, I suggest you take out emotion and consideration of fair and unfair. Prejudice takes away from understanding the whole. Once you have a grasp of the whole, then you can apply your opinion to what kind of world you want to live in and the impact of how you think best to get there. If your tax advisor brings up Republicans or Democrats separately as a specific reason why your tax return is the way it is, consider finding a different advisor. When I told a friend what I did was a form of warfare, I was basically trying to brag about my work, but really, I was saying “I don’t know what the hell I’m talking about, but want you to think I’m important.”

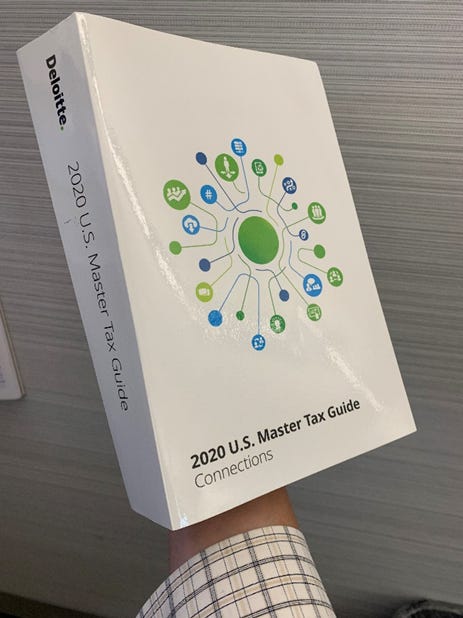

This book is a topical guide, a brochure of United States federal income tax. I get a new one every year. It’s 1,000 pages. It tells me a brief definition level of an income tax topic, and then it tells me what primary source I need to reference to learn more, in order to properly report (declare) on it. It’s my compass for income tax. Just US income tax. The primary source information in the form of code and regulation is the map. Your return in any given year is where you were somewhere on the map during 1 calendar year. This doesn’t include specific state taxation or the myriad of other taxes that exist in the world that you, whether directly or indirectly, ultimately pay. Even if you hoard cash or property, inflation is a supernatural form of taxation that benefits or costs you.

If your tax return doesn’t reflect what happened, you’ve either committed fraud or committed a reporting error through willful or unwilful ignorance. Sometimes either of those things can work in your favor or the government’s favor in terms of what you should have reported versus what was reported. Even if you pay someone to prepare the report, it’s ultimately your job to ensure its accuracy. Even the billionaire or the CFO who signs their return or the company’s return is where the buck stops. They just have cash to pay lawyers to keep a cushion between threat and action of enforcement. Enforcement in the form of when the taxpayer must surrender their life through incarceration, or their property in the form of penalties and interest tacked on to the owed tax.

Arbitrage and uncertain tax positions.

To you, probably when you think of taxes you think of your hourly wage multiplied by the hours you’ve worked and the amount you get in your check. You think about them when you start a new job when deciding what to “claim” and then when you file your return every year before April 15 (usually) to report what happened during the tax year.

What your employer takes out of your check on your behalf, or you pay as an estimate, that is a prepayment, paid to the Internal Revenue Service (IRS) who operates on behalf of the federal United States government. You can also pay your state or local municipality that you may live and/ or work in. The tax year begins (usually) on January 1 or on the date of your birth. The tax year ends (usually) on December 31 or the date of your death.

When you file your return that is the date of event that creates the moment of reporting, or your declaration of what events occurred during the previous year to create the tax.

In accounting, where things get interesting, or by that I mean complicated & boring, is how we report events that occurred because of tax policy and how we report that information financially or statutorily. There are differences in what you interpret on a financial statement and what gets reported and paid to the government.

It all revolves around deferral of tax.

Desktop:

Most of this work was conducted on my spiral notebook. Not a lot of notes. I shot from the hip on this one after writing out a couple of pages by hand.

Goal for publish: Blog, podcast. Friday evening. [I’m a month late]

Currently reading: Grapes of Wrath, written by: John Steinbeck

https://www.goodreads.com/book/show/18114322-the-grapes-of-wrath

Currently listening: Remember the Name, performed by: Fort Minor

https://music.apple.com/us/album/remember-the-name-feat-styles-of-beyond/95787592?i=95786277

Currently viewing: The Sum of All Fears, Starring: Ben Affleck & Morgan Freeman

https://www.imdb.com/title/tt0164184/

Certainties.

I’m sure he likes you too.

Are taxes terrible?

Can you talk about taxes in a way that’s fun and entertaining? I’m not sure that’s possible.

Jesus and Tax Collectors. The skim. Hard to really do that now unless you completely relinquish control.

Taxes are for poor people.

The lottery.

A billionaire’s “tried and true” effective tax rate is probably much lower than even compared to someone on welfare.

Blessed are the poor in spirit.

What the hell does that even mean?

Value in your tax situation lies in planning.

Tax deferral is the name of the current game.

Payroll tax. You surrender 7.5%, your employer pays 7.5% and makes the payment and filing on your behalf.

You’re still required to report your income even if it’s from illegal sources.

Our imports are taxed through treaties. There are treaties between countries to create exceptions.

Basically, there are more forms of taxation than ever.

Keep your political leaning at bay while trying to understand.

Link to:

The Electronic Pack Rat’s Guide to Goal Setting

Thank you for reading.

Please give me the opportunity to be wrong. I’m looking for your help to provide feedback, guidance, and support. Please let me know how this engages you. You can do a thing. I can do a thing. Together we can do great things. Please consider subscribing, liking, sharing, tweeting, texting, forwarding, faxing, printing, snail mail, & airborne leaflet propaganda. It just needs to catch the Forward Flu (go viral).

Be kind to yourself and others.

Sean Dowd, June 30, 2022

79°F Sunny

945 N Jackson St, Dansville, MI 48819

Death and Taxes